how to calculate taxes taken out of paycheck in illinois

Payroll taxes that both employees and employers pay. Unlike your 1099 income be sure to input your gross wages.

A standardized template should have tabs for each month with links to formulas that calculate employee taxes deductions and pay.

. Yet only about one-third of Americans know what the account actually does which can hurt long-term. Calculate your paycheck in 5 steps. The employee will need the.

Investing in a 401k is one of the main ways many US. To put it one way all payroll taxes are employment taxes but not all employment taxes are considered payroll taxes. When we talk about FICA taxes the two factors at play are Social Security and Medicare.

There are five main steps to work out your income tax federal state liability or refunds. This paystub includes details about your pay including how much money youve earned for that pay period and the year-to-date payroll. The lack of income taxes means more money in your pocket throughout the year.

Report these taxes on line 16f of Schedule K and in box 16 of Schedule K-1 using code F. Taxes for remote employees out of your state. First you need to take a look at the template and evaluate your business needs.

Gross income is the total amount of income paid to you by your employer. A paystub is a paycheck you receive from your employer every time you get paid. First you need to determine your filing status to understand your tax bracket.

Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. It will also show what deductions and taxes have been taken out of your total earnings. If your employee works from home in another state there are three things you need to do.

Register with your employees state tax agency. Use your current monthly income to determine your annual income. Meaning your pay before taxes and other payroll deductions are taken out.

In addition to regular income tax freelancers are responsible for paying the self-employment tax of 153 in 2021This tax represents the Social Security and Medicare taxes that businesses pay and that employees have taken out of their paychecks automatically. Here are some more examples of situations in which you may need to calculate retroactive pay. How Your South Dakota Paycheck Works.

Pay me now or pay me later says Michael Menninger a certified financial planner with. These deductions include such things as federal state and local taxes and also Social Security taxes. So taxes come out first.

With careful attention to compliance employers can help fulfill this societal benefit and avoid significant penalties. Then the wages are garnished. An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department.

W-2 income. Switch to Illinois hourly calculator. Similarly if you were out of work for four out of the last six months before finding a new job your average income under the means test will be much lower than what youre making now.

Step 1 Filing status. Since youll be withholding income taxes in your employees home state youll need to register with the state and possibly local tax agencies. Creditable foreign taxes under sections 901 and 903.

Take your current monthly income as calculated and multiply it by 12. A pretax deduction is taken out of your pay before any taxes are withheld so it reduces your taxable income. Post-tax deductions are taken out after your income and payroll taxes have been withheld.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. When youre self-employed you are your own bosswhich is great news until tax time. Workers build up savings for retirement.

This box is optional but if you had W-2 earnings you can put them in here. Federal income taxes except for the portion of built-in gains tax allocable to ordinary income or taxes reported elsewhere on the return. Married Filing Jointly or Widower Married Filing Separately.

Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future. Taxes allocable to a rental activity. The federal income FICA and state income taxes.

How You Can Affect Your Oklahoma Paycheck. Meanwhile payroll taxes are those that are taken out from an employees paycheck and matched by their employerand more specifically Social Security and Medicare taxes. When it comes to the IRS its a simple concept.

In reality however payroll taxes are different from income taxes and serve a distinct purpose for public welfare. Since South Dakota is one of seven states with no personal income tax FICA and federal income taxes are the only concern for workers here. Payroll runs the employees last paycheck using the old pay rate to calculate earnings.

Over the years the term payroll tax has become synonymous with all things taxes on a pay stub. It is the amount before taxes social security pension and other benefits are taken out. Other tax-free deductions such as 401k contributions are taken out after garnishment.

There are 4 main filing statuses. In Illinois that means any earnings remaining after legally required deductions. It is not the amount you receive in your paycheck each pay period but rather the amount before deductions.

A financial advisor in Oklahoma can help you understand how taxes fit into your overall financial goals. CPE courses - MasterCPE specializes in quality CPE courses professional CPE courses online CPE for account and tax professionals. Figuring out how to do payroll using an Excel template can take some time.

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template

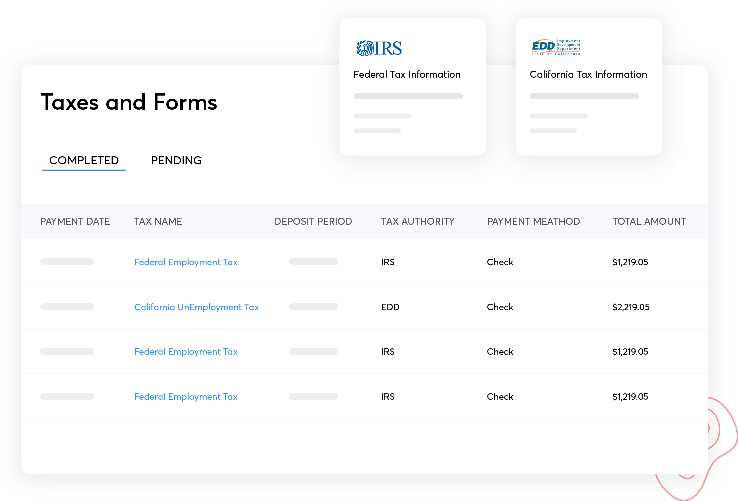

Online Payroll Software For Businesses Zoho Payroll

Paycheck Calculator Take Home Pay Calculator

Different Types Of Payroll Deductions Gusto

The Pros And Cons Biweekly Vs Semimonthly Payroll

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Here S How Much Money You Take Home From A 75 000 Salary

Ready To Use Paycheck Calculator Excel Template Msofficegeek

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Illinois Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Futa Sui And More Surepayroll